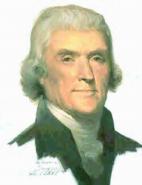

Thomas Jefferson boasts about having reduced the size of government and eliminated a number of “vexatious” taxes (1805)

About this Quotation:

We have gradually added to the OLL a number of collected works of the Founding Fathers known as the Federal Edition which were published in the early 20th century and which were the most authoritative editions available until the mid-20th century. We have editions of Jefferson and Hamilton, and John Quincy Adams and George Washington to come. The powerful search engine built into the OLL website enables one to search the works of Jefferson, for example, in one go and thus uncover unexpected gems. One wonders how many times in American history a President could boast of eliminating a number of “vexatious” internal taxes, as Jefferson does here? A Google search done in September 2009 for the phrase “Federal Edition” produced the OLL edition of the Federal Edition of Hamilton as the number one hit, followed in second place by “Turbo Tax Preparation Software” - an irony I’m sure Jefferson would have appreciated.

Other quotes from this week:

- 2010: Herbert Spencer worries that the violence and brutalities of football will make it that much harder to create a society in which individual rights will be mutually respected (1879)

- 2008: William Findlay wants to maintain the separation of church and state and therefore sees no role for the “ecclesiastical branch” in government (1812)

- 2007: John Adams argues that the British Empire is not a “true” empire but a form of a “republic” where the rule of law operates (1763)

- 2006: Montesquieu thought that commerce improves manners and cures “the most destructive prejudices” (1748)

- 2006: Benjamin Constant argued that mediocre men, when they acquired power, became “more envious, more obstinate, more immoderate, and more convulsive” than men with talent (1815)

Other quotes about Taxation:

- 2009: Lysander Spooner argues that according to the traditional English common law, taxation would not be upheld because no explicit consent was given by individuals to be taxed (1852)

- 2009: Thomas Paine responded to one of Burke’s critiques of the French Revolution by cynically arguing that wars are sometimes started in order to increase taxation (“the harvest of war”) (1791)

- 2009: Frédéric Bastiat on the state as the great fiction by which everyone seeks to live at the expense of everyone else (1848)

- 2008: Adam Smith claims that exorbitant taxes imposed without consent of the governed constitute legitimate grounds for the people to resist their rulers (1763)

- 2008: Alexander Hamilton denounces the British for imposing “oppressive taxes” on the colonists which amount to tyranny, a form of slavery, and vassalage to the Empire (1774)

- 2008: Jefferson tells Congress that since tax revenues are increasing faster than population then taxes on all manner of items can be “dispensed with” (i.e. abolished) (1801)

- 2007: Frédéric Bastiat and the state as “la grande fiction à travers laquelle Tout Le Monde s’efforce de vivre aux dépens de Tout Le Monde (1848)

- 2007: William Graham Sumner reminds us never to forget the “Forgotten Man”, the ordinary working man and woman who pays the taxes and suffers under government regulation (1883)

- 2007: Frank Chodorov argues that taxation is an act of coercion and if pushed to its logical limits will result in Socialism (1946)

- 2005: John C. Calhoun notes that taxation divides the community into two great antagonistic classes, those who pay the taxes and those who benefit from them (1850)

- 2005: David Ricardo considered taxation to be a “great evil” which hindered the accumulation of productive capital and reduced consumption (1817)

- 2005: Thomas Hodgskin noted in his journey through the northern German states that the burden of heavy taxation was no better than it had been under the conqueror Napoleon (1820)

24 January, 2005

| Thomas Jefferson boasts about having reduced the size of government and eliminated a number of “vexatious” taxes (1805) |

In Jefferson’s Second Inaugural Address of March 4, 1805 he boasted of having reduced the size and cost of government enough to eliminate a number of "vexatious" internal taxes which he feared might grow in number and eventually be applied to other goods:

At home, fellow citizens, you best know whether we have done well or ill. The suppression of unnecessary offices, of useless establishments and expenses, enabled us to discontinue our internal taxes. These covering our land with officers, and opening our doors to their intrusions, had already begun that process of domiciliary vexation which, once entered, is scarcely to be restrained from reaching successively every article of produce and property.

The full passage from which this quotation was taken can be be viewed below (front page quote in bold):

At home, fellow citizens, you best know whether we have done well or ill. The suppression of unnecessary offices, of useless establishments and expenses, enabled us to discontinue our internal taxes. These covering our land with officers, and opening our doors to their intrusions, had already begun that process of domiciliary vexation which, once entered, is scarcely to be restrained from reaching successively every article of produce and property. If among these taxes some minor ones fell which had not been inconvenient, it was because their amount would not have paid the officers who collected them, and because, if they had any merit, the state authorities might adopt them, instead of others less approved.

The remaining revenue on the consumption of foreign articles, is paid cheerfully by those who can afford to add foreign luxuries to domestic comforts, being collected on our seaboards and frontiers only, and incorporated with the transactions of our mercantile citizens, it may be the pleasure and pride of an American to ask, what farmer, what mechanic, what laborer, ever sees a tax-gatherer of the United States? These contributions enable us to support the current expenses of the government, to fulfil contracts with foreign nations, to extinguish the native right of soil within our limits, to extend those limits, and to apply such a surplus to our public debts, as places at a short day their final redemption, and that redemption once effected, the revenue thereby liberated may, by a just repartition among the states, and a corresponding amendment of the constitution, be applied, in time of peace, to rivers, canals, roads, arts, manufactures, education, and other great objects within each state. In time of war, if injustice, by ourselves or others, must sometimes produce war, increased as the same revenue will be increased by population and consumption, and aided by other resources reserved for that crisis, it may meet within the year all the expenses of the year, without encroaching on the rights of future generations, by burdening them with the debts of the past. War will then be but a suspension of useful works, and a return to a state of peace, a return to the progress of improvement.

I have said, fellow citizens, that the income reserved had enabled us to extend our limits; but that extension may possibly pay for itself before we are called on, and in the meantime, may keep down the accruing interest; in all events, it will repay the advances we have made. I know that the acquisition of Louisiana has been disapproved by some, from a candid apprehension that the enlargement of our territory would endanger its union. But who can limit the extent to which the federative principle may operate effectively? The larger our association, the less will it be shaken by local passions; and in any view, is it not better that the opposite bank of the Mississippi should be settled by our own brethren and children, than by strangers of another family? With which shall we be most likely to live in harmony and friendly intercourse?